In 2021, the global market for AI in fintech reached a valuation of USD 9.75 billion, with projections estimating it will soar to USD 38.39 billion by 2030, reflecting an annual growth rate of 16.45% over the forecast period (2022–2030), as detailed by Straits Research’s “AI in Fintech Market Size, Share & Forecast to 2030.”

Artificial intelligence (AI) is making a big impact on the Banking & Finance industry, providing fresh ways to meet the growing demand for smarter, safer, and more convenient financial services. Whether it’s improving how we assess credit, handle trading, or manage financial risks, AI is changing the way people manage their money.

With the market continuing to grow, it’s important to get familiar with the main applications and benefits of AI in finance. Let’s explore the key areas where AI is becoming more widely used and the trends shaping the future of this industry.

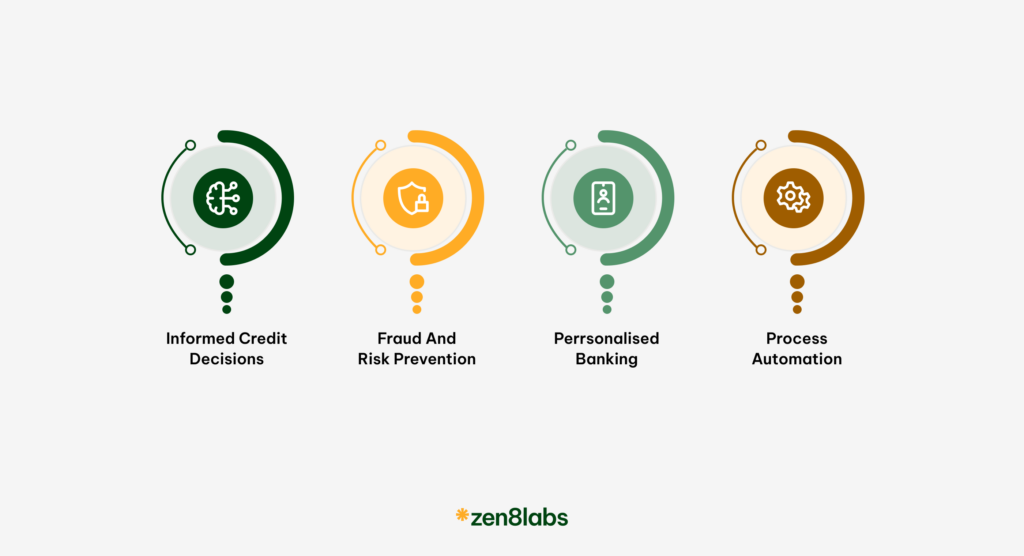

Benefits of AI in Finance

Automation

The integration of AI in finance has brought significant advancements, allowing a wide array of activities—from simple administrative tasks to complex decision-making processes—to be automated. For example, a payments company might implement AI to continuously monitor network traffic, improving cybersecurity without the need for constant human oversight. In banking, AI enhances the customer experience by providing faster and more personalized services, ensuring smoother and more secure interactions.

One of the most notable impacts of AI in banking is in customer service, where AI-driven chatbots and virtual assistants provide round-the-clock support, improving the customer experience while lowering operational costs. The future of AI in finance appears promising, with ongoing technological advancements expected to expand its role even further, leading to more innovative applications and services. Current statistics indicate a positive trend in AI’s impact on finance, showing reduced operational costs, increased revenue, and enhanced customer satisfaction.

Speed

AI processes information far faster than humans, uncovering patterns and relationships in data that might otherwise go unnoticed. This leads to quicker insights for decision-making, trading, risk modeling, compliance management, and more. What’s more, AI makes these decisions almost instantly by using conditional logic, removing emotional bias from the process. Approvals or denials are determined purely by whether specific conditions are met.

In the banking industry, AI also enhances the customer experience by connecting third-party services through APIs, making processes faster and more convenient. By automating these tasks, AI significantly reduces the time needed for month-end reconciliation, freeing accountants and finance professionals to focus on more strategic, value-adding activities that improve overall business efficiency.

Customized services

Traditional approaches to product offerings often overwhelmed consumers with numerous credit card offers, loans, and investment opportunities, leading to confusion and low conversion rates. However, by using machine learning models, financial institutions can better understand individual customer situations. For example, AI can identify when a customer has experienced a loss of income, indicating a need for mortgage assistance, or recognize a recent salary increase and vacation purchases, suggesting that a travel rewards credit card might be appealing.

This personalization stems from sophisticated data management strategies, where AI systems analyze customer data to predict financial behavior and preferences. By developing customized investment and savings plans, AI can recommend the most suitable products and strategies for each customer, fostering stronger relationships.

Accuracy

AI significantly reduces manual errors in financial services by automating tasks like data processing, analytics, document handling, onboarding, and customer interactions. By following consistent processes, AI boosts accuracy and reliability, making decisions based on this data more trustworthy.

One of the reasons AI delivers such precise results is due to its ability to work with high levels of granularity—meaning the level of detail it can analyze. For instance, when categorizing transactions, many financial institutions rely on merchant category codes (MCCs), which aren’t always available. AI, however, goes deeper, analyzing various layers of data to provide more accurate insights.

Consider a transaction labeled “Starbucks – $0.99.” At a basic level, AI might categorize this as a coffee shop purchase. However, with deeper analysis, AI can identify that a $0.99 charge is more likely for something like a digital app purchase or a small item, rather than a typical coffee order. This deeper analysis improves the accuracy of financial management and decision-making, showing how AI enhances operations with a fine-tuned understanding of the details.

What are the current AI trends?

1. Multimodal AI

Multimodal AI refers to systems that can process and analyze multiple forms of data—such as text, images, and voice—simultaneously, similar to how humans use different senses to understand the world. These systems utilize machine learning algorithms to detect patterns and relationships within diverse data sources, making them highly adaptable across industries like retail, healthcare, finance, and entertainment.

In the finance industry, multimodal AI offers transformative benefits. By integrating and analyzing various data types in real time, it enhances fraud detection, improves customer service through more interactive virtual assistants, and strengthens risk assessments by pulling insights from multiple financial data streams. Ultimately, multimodal AI boosts efficiency, accuracy, and innovation in financial services.

2. AI-Powered Chat

AI chatbots in the finance industry are sophisticated tools that help financial operations and customer interactions. Unlike traditional systems, these chatbots use natural language processing (NLP) and machine learning (ML) to understand and respond to queries in a conversational, human-like manner. This allows them to assist with everything from routine customer service questions to more intricate financial advice.

One of the key advantages of AI chatbots is their ability to instantly analyze and interpret data across multiple financial departments, offering immediate insights into areas like budgeting, forecasting, and expenditures. By automating data analysis and providing quick, accurate responses, they reduce the manual work finance professionals often face and help businesses make quicker, more informed decisions. These AI-driven tools not only improve operational efficiency but also elevate the overall customer experience in financial services.

3. Small Language Models (SLMs)

Small Language Models (SLMs) are gaining traction in the realm of artificial intelligence, particularly within Natural Language Processing (NLP). Despite their compact architecture and fewer computing resources compared to Large Language Models (LLMs), SLMs possess billions of parameters that enable them to operate efficiently on devices like smartphones. This democratization of AI has led to a surge in user-friendly applications that require minimal financial investment and only a browser to access.

In 2024, the focus on SLMs is shifting from sheer size to precision and efficiency, making them ideal for targeted business applications. Tailored specifically for various domains, including finance, SLMs excel in processing complex financial data, thereby accelerating data processing tasks such as invoice management and payment reconciliation. Their specialized nature allows finance teams to work more efficiently, facilitating improved decision-making through accurate insights. By identifying cost-saving opportunities and detecting inconsistencies in financial records, SLMs are enhancing the operational capabilities of financial professionals, ultimately driving real-world value in the finance industry.

Conclusion

The financial services sector has made significant strides in adopting AI over the past few years. While much of the focus has been on improving efficiency and optimizing costs, many Chief Information Officers (CIOs) in this field are now keen to pursue top-line growth. Achieving this will require collaboration with business units to explore how AI can drive innovative ways of working, develop new products, and create capabilities that boost revenue generation.

As we look ahead to the role of AI in financial services, the potential for transformation is substantial. Technology development companies like zen8labs are leading this change, using AI technologies to support organizations in their pursuit of growth. With our expertise in providing customized solutions, zen8labs is well-equipped to guide financial institutions in maximizing AI’s full potential.

To learn more about how zen8labs can help your organization’s success in the finance industry, don’t hesitate to reach out to us today!